Posted on

How to Become a Registered Tax Agent in Australia

3 min read

Are you considering a career as a tax agent or are you simply curious about the roles, responsibilities and opportunities this profession offers.

Understanding the Role of a Registered Tax Agent

Tax agents play a crucial role in helping individuals and businesses navigate their tax obligations. They provide tax advice, prepare tax returns and assist clients with various tax matters. In Australia, only registered tax agents are legally allowed to charge for these services ensuring that they meet a high standard of expertise and professionalism as mandated by the Tax Practitioner Board (TPB).

Key Responsibilities of a Tax Agent

A tax agent's responsibilities may include:

- Preparing tax returns, notices, statements and applications

- Lodging returns, notices, statements and applications

- Assisting clients with tax concessions

- Advising clients on taxation laws applicable to their obligations

- Representing clients in dealings with the Australian Taxation Office (ATO)

Eligibility Requirements

To apply to become a registered tax agent, you must meet the following criteria:

- Be at least 18 years of age

- Be considered a fit and proper person

- Satisfy the qualification and experience requirements

- Complete an online application and submit all supporting documents

Qualifications and Experience Needed

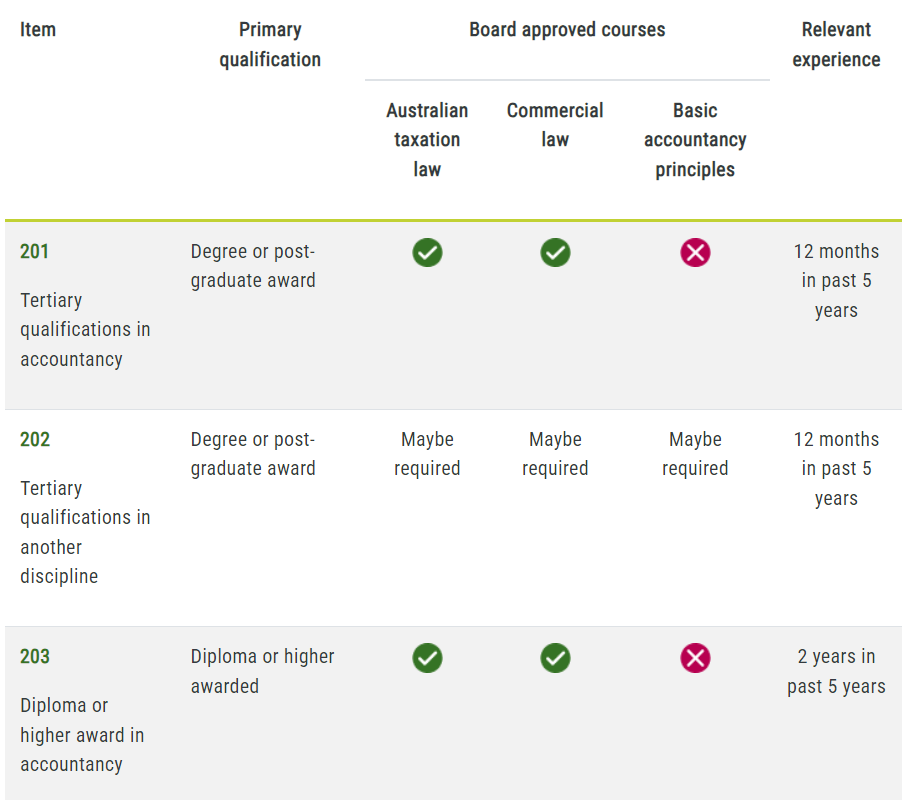

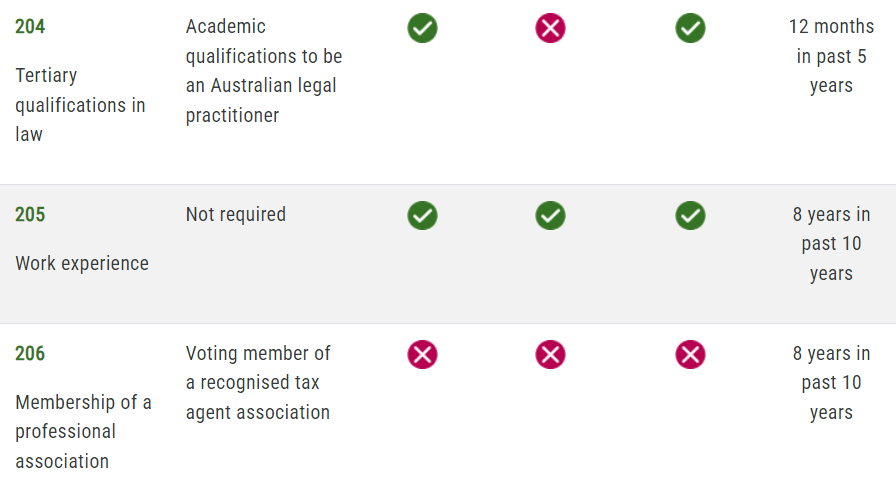

The Tax Agent Services Regulations 2022 (TASR) outlines the qualifications and experience necessary for becoming a registered tax agent. Candidates typically need a combination of a primary qualification, board approved courses and relevant work experience.

For instance, the NBIA FNS50222 Diploma of Accounting along with the Tax Agent Certification (FNSSS00005/FNSSS00008) fulfils both the qualification and board approved course requirements. The specific number of courses and hours of experience required will depend on your existing qualifications.

What Constitutes Relevant Experience?

Relevant experience refers to hands on experience in tax related roles. This can include working as a registered tax agent, under the supervision of a registered tax agent, or as a legal practitioner. To be considered relevant, this experience should involve direct engagement in tax agent services or areas of tax law associated with those services.

Registration Process

The application process is completed online through a TPB account. To get started, create a unique username and password. The application fee for individuals in 2024 in $273 subject to annual adjustments based on the consumer price index.

Before you begin your application, ensure you have electronic copies of all required supporting documents. You will receive notification of your application's success or rejection within 30 days.

Important Note

The information in this article serves as a guide. We recommend conducting your own research to ensure you have the most up to date information.

If you're interested in learning more about the NBIA Tax Agent Certification, please contact us at admin@nbia.edu.au or call us at 03 9584 0900.

Ready to kick start your career as a Tax Agent? Enrol now!

Tpb.gov.au. (2023). Tax agent registration | Tax Practitioners Board. [online] Available at: https://www.tpb.gov.au/tax-agent-registration.